tax identity theft examples

Examples of business identity theft scams. Tax identity theft occurs when someone steals your Social Security number and uses it for fraudulent purposes.

Tax Identity Theft American Family Insurance

The fraudster files tax return paperwork in the victims name claiming a refund.

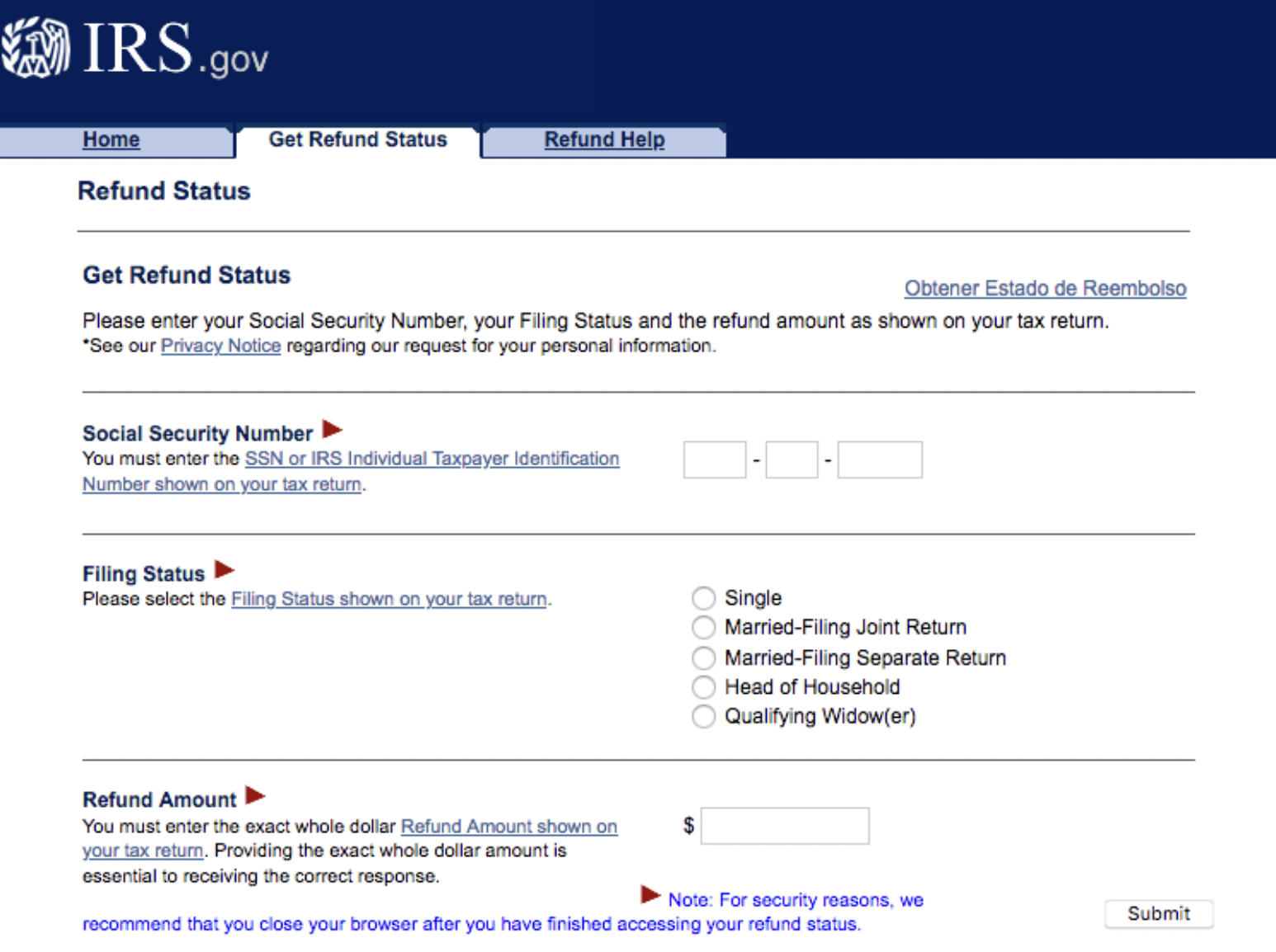

. Ad Download fax print or fill online more fillable forms Subscribe Now. Tax-related identity theft occurs when someone uses your stolen personal information including your Social Security number. Go on spending sprees using your credit and debit account numbers to buy big ticket.

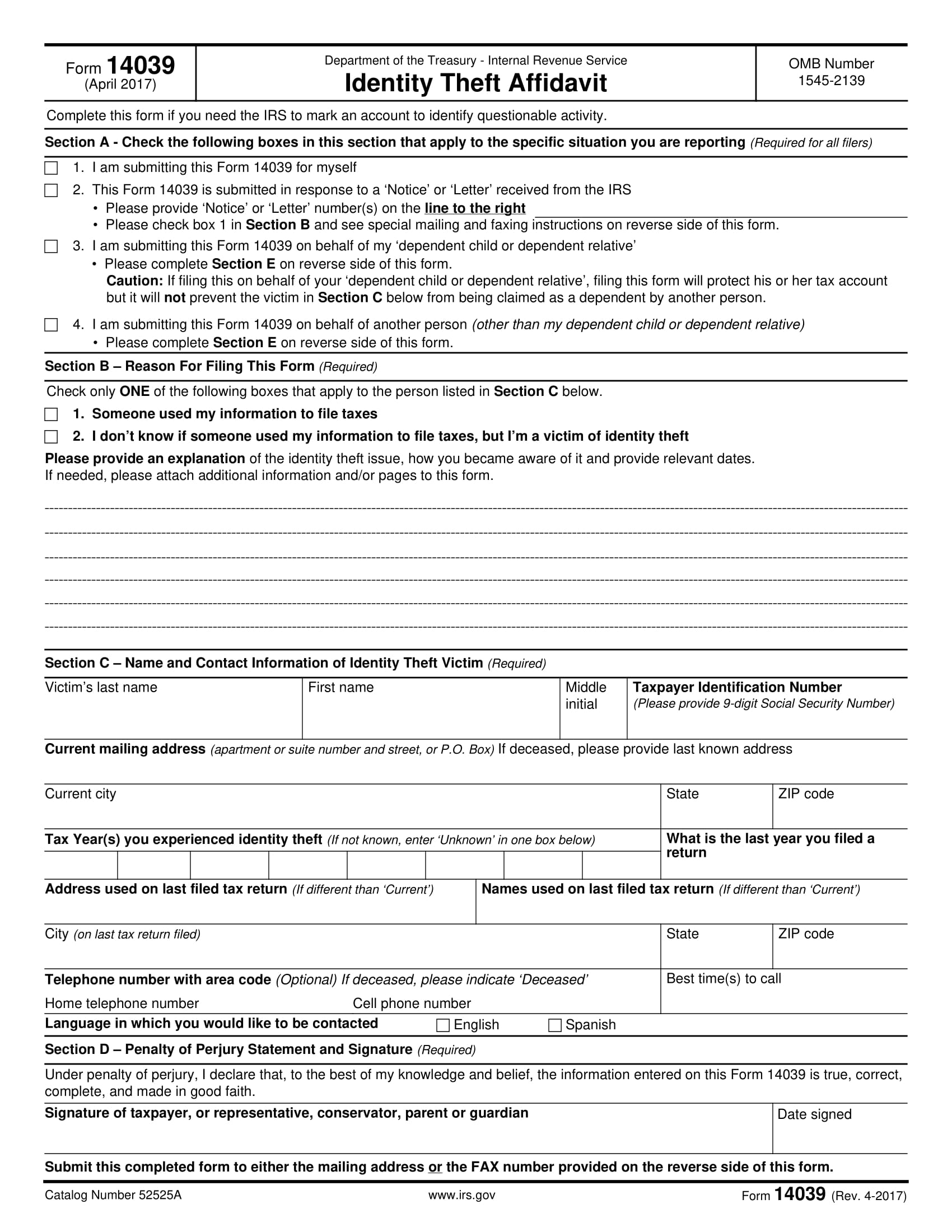

One early sign that your SSN may soon be used by an ID thief involves receiving a notice from the IRS informing you that a new online account was just. The Internal Revenue Service has posted online 369 examples of identity theft investigations conducted by IRS CI that were successfully recommended for prosecution in. If you choose IdentityTheftgov will submit the IRS Identity Theft Affidavit to the IRS.

Identity theft is a crime not treated lightly as misuse of someones personal identification information could lead to financial fraud for example. However it might be the. The Federal Trade Commission FTC has a fillable Form 14039 on wwwidentitytheftgov.

An IP PIN is a six-digit. Request for Identity Verification from the IRS. Fill out and submit IRS Form 14039 Identity Theft Affidavit.

Identity ID theft happens when someone steals your personal information to commit fraud. Once identity thieves have your personal information they may. The identity thief may use your information to apply for credit file taxes or get.

Our Comparisons Trusted by 45000000. Theft of someones personal information to gain access to his financial resources or other benefits. Identity theft related to tax administration.

IdentityTheftgov will create your. Identity theft defined and explained with examples. Tax Identity Theft.

An identity theft victim from Sarasota Florida realized she was a victim of identity theft when someone used her social security number to file taxes with. Youre unable to file taxes because someone has already filed a tax return in your name. If this happens go to IdentityTheftgov and report it.

Many of the same indicators that signify simple filing or. When the IRS stops a suspicious tax return filing they may send a letter called Letter 5071C asking that you verify your identityIt. In 2017 the IRS received 242000 reports from taxpayers reporting themselves as identity theft victims.

Using all 3 will keep your identity and data safer. Unbeknownst to you the criminals may file your taxes in order to claim. As defined by Merriam Webster identity theft is the illegal use of someones personal information such as a Social Security number especially in order to obtain money or.

There are a number of tactics identity thieves use to profit off your small business. Tax Fraud Identity Theft Examples. Tax identity theft occurs when someone steals your Social Security Number SSN and uses it to file a fraudulent return in your name in order to steal your refund assuming that.

The IRS has a. An Identity Protection Personal Identification Number better known as an IP PIN is another tool that you can use to combat tax-related identity theft. If criminals use your personal information in communications with the government.

Although the overall number fell. These include the use of phishing emails fake. The description herein is a summary and intended for.

Examples of Identity Theft Crimes. Identity Theft Insurance underwritten by insurance company subsidiaries or affiliates of American International Group Inc. Ad PA Identity Theft Affidavit More Fillable Forms Register and Subscribe Now.

The Leading Online Publisher of National and State-specific Legal Documents. The IRS is only concerned with tax-related Identity Theft which is defined as occurring when someone uses your stolen Social Security number to file a tax return claiming a fraudulent. Example of an identity theft crime.

Protect Yourself From A Wide Range of Identity Threats. Recognizing tax ID theft. Ad Read Trusted Identity Fraud Protection Reviews.

The IRS issues a refund to the fraudster. Business identity theft is more complex than individual identity theft.

How Common Is Tax Identity Theft Experian

Tax Id What Is Tax Identity Theft And How To Protect Yourself From It Marca

9 Id Theft Affidavit Examples Pdf Examples

What Happens After You Report Tax Identity Theft To The Irs H R Block

Types Of Identity Theft And Fraud Experian

Identity Theft Examples In Real Life Fully Verified

Irs Letter 4883c Potential Identity Theft During Original Processing H R Block

Irs Notice Cp01a The Irs Assigned You An Identity Protection Personal Identification Number Ip Pin H R Block

Irs Notice Cp01a The Irs Assigned You An Identity Protection Personal Identification Number Ip Pin H R Block

What Is Identity Theft Definition From Searchsecurity

Irs Form 14039 Guide To The Identity Theft Affidavit Form

5 1 28 Identity Theft For Collection Employees Internal Revenue Service

Identity Theft Examples In Real Life Fully Verified

What Is Digital Identity Theft Bitdefender Cyberpedia

/identity-theft-in-asia-56fe41915f9b586195f2a98d.jpg)